For many CPG brands, purchasing syndicated sales data from IRI or Nielsen is a critical part of understanding the journey their products make from distribution through to purchase. Sure, your distribution data can tell you exactly what you shipped to each retailer and when, but it does little to help you understand what happens to your products between when they arrived at the store through the back door and when they left in a shopping cart through the front door. That's where consumption data comes in, helping brands paints a more complete picture of how their products are sold at the store level.

Traditionally, it was shopper marketing and category management teams that cared the most about point-of-sale data. But more and more, field sales and merchandising teams are starting to leverage this data source as a way to estimate in-store conditions in-between store visits. While previously they may have had to rely on pre-set routes and past store performance, consumption data can help them prioritize stores with potential retail execution errors, or opportunities for growth, and take action sooner.

In this blog post, we’ll break down exactly how brands are using their syndicated point-of-sale data to find sales opportunities and optimize their retail activities in the field.

- Use Store-Level Sales Trends to Find Execution Errors

- Track SKU-Level Sales to Anticipate Out-of-Stocks

- Automate Distribution Voids

- Equip Reps With Up-to-Date Sales Data

1. Use Store-Level Sales Trends to Find Execution Errors

When you think of field teams, it’s easy to think about the big wins they achieve, things like securing secondary displays and winning premium positions at the home shelf.

While your field team surely spends lots of their time looking for ways to expand your footprint in the store, perhaps more important is the “dirty work” they do to make sure every store is in compliance with the planogram and promotion agreements. Poor in-store execution can pull sales down by as much as 25%, so simply driving compliance can be as important as winning a flashy new display.

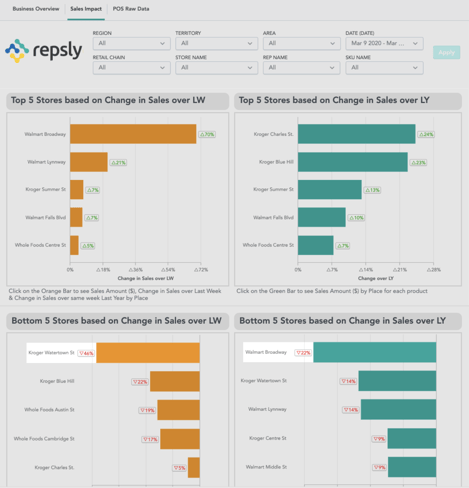

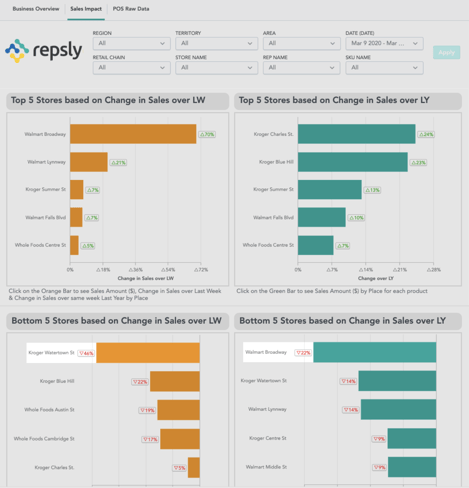

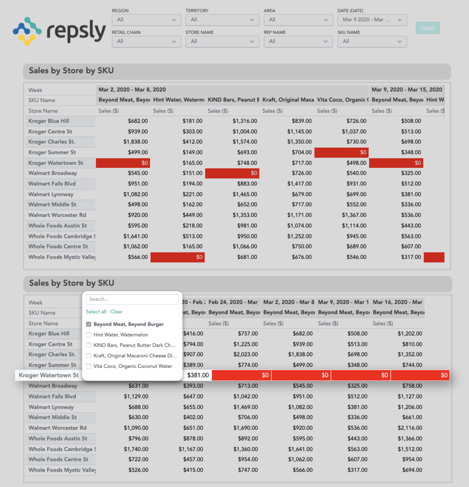

Repsly’s Retail Sales Reporting automatically detects potential execution errors so your reps can prioritize the stores where they can have an immediate impact on compliance — and therefore on sales.

One way many brands do that is to flag stores that underperform on a week-over-week or year-over-year basis. For example, a 15% drop in sales week-over-week could be a sign that you lost a premium shelf placement, or that a competitor displaced an important SKU. Repsly’s Retail Sales Reports highlight stores with potential errors in between store visits so you can prioritize the accounts that need attention, even if they weren’t already on the schedule for that week.

Field sales teams can spot and prioritize underperforming stores by using their POS data to compare store-level performance by week or month.

2. Track SKU-Level Sales to Anticipate Out-of-Stocks

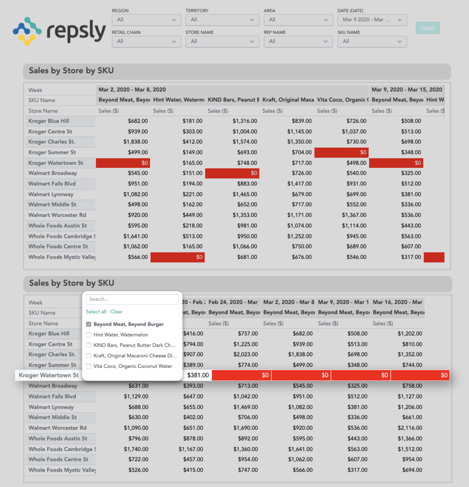

In addition to finding sales opportunities in underperforming stores, brands can also use their point-of-sale data to uncover potential out-of-stocks. Tracking individual SKU performance week-over-week is a good way to identify stores with empty shelves, or even recognize when a store is on the brink of an out-of-stock. By using their point-of-sale data to recognize these risks before their team makes a store visit, brands are able to deploy their teams and fill shelves much faster than if they had waited until their rep’s next regularly scheduled visit to that store.

3. Automate Distribution Voids

Another way your field team can move the needle on sales is by finding and fixing distribution voids. Voids can be hard to spot during routine store visits because there’s not an empty slot on the shelf to indicate a product is missing. But whether the shelf is empty or not, having an entire SKU fall out of distribution can drag your category sales down as you miss out on opportunities to build cart size or introduce new products to fans of your brand.

Using your syndicated sales data, Repsly’s Retail Sales Reporting can flag distribution voids even in stores your team hasn’t been out to visit. Repsly can cross-reference SKU-level sales with the list of your products approved for distribution in each store, and point out instances where a product may have fallen out of distribution. You can then sort the store list to view the voids that have lasted the longest, and dispatch your team to take action in each account.

Merchandising and sales teams can use distribution reports like these to spot potential OOS and voids.

4. Equip Reps With Up-to-Date Sales Data

So far, we’ve focused on ways brands can use consumption sales data to find sales opportunities from the home office. But brands can take it a step further by giving their sales reps direct access to sales data in the field. Armed with the latest sales trends for each specific store they visit, your reps will be able to do two things:

Quickly determine which products or categories need attention

When reviewing sales trends in their accounts reps will be able to see which SKUs have struggled since their last visit. Low sales could indicate execution errors, competitive activity, or simply that they should phase out one SKU in favor of another. With this data on hand, reps can take a tailored approach to each store they visit based on demand.

Start data-driven conversations with retailers

Retail buyers and category managers deal with dozens of brand reps and brokers. Armed with actual sales data from their store, reps can cut through the noise and make a stronger case for their brand. Perhaps a certain SKU has sold well for a month straight and gone out of stock a few times over that period. With the sales data to prove it, a rep could make a strong case for placing a larger order and displacing a competitor in a prime off-shelf placement. With sales data at their fingertips, reps can position themselves as a helpful consultant that can work with buyers to grow the category.

.jpg?width=510&name=Woman%20with%20Phone%20in%20Store%20(1).jpg)

Repsly’s Retail Sales Reporting gives brands access to reports like these right out of the box, with no coding or IT involvement required. Talk to us today to learn more about how you can leverage your syndicated sales data to drive execution and sales in the field.

Photo credit: Virginia Retail via Flickr, licensed under Creative Commons.

.jpg?width=510&name=Woman%20with%20Phone%20in%20Store%20(1).jpg)