As food and beverage manufacturers, you have to manage a two-part sales process. First up is the sale you make to retailers - the sale that most directly affects your bottom line. Then there’s the eventual sale the store makes to your end consumer. While you have less control over these purchases, they’re arguably more important since consumer interest drives wholesale demand.

If you have a sales team selling large deals direct to retailers, it can be relatively easy to track these orders. However, it can be far more difficult to keep track of your product’s velocity off the shelf. With a bit of creativity, however, innovative brands have figured out clever ways to track these figures. Here are three hacks that can help you mine retail sales data.

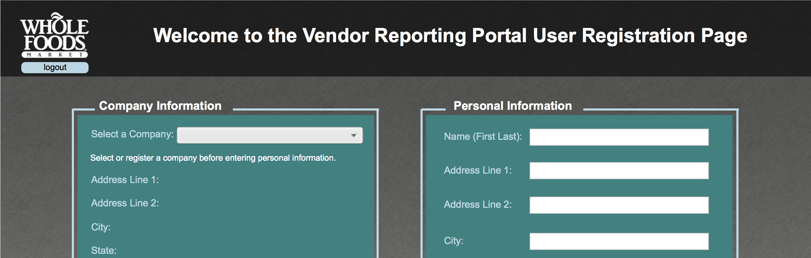

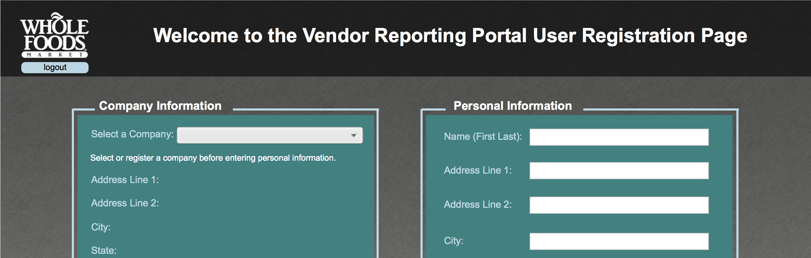

Ask About Your Retailers’ Vendor Sales Portal

Some large retail chains have a vendor sales portal where suppliers can log in and view scan data down to the individual store level. This is obviously the ideal source for manufacturers, since they can get data specific to the individual store and SKU, and can log in to view it on demand.

However, typically only retail giants like Whole Foods have these kind of sales portals. Even still, it’s worthwhile to ask every one of your accounts if they share this data online, since the payback could save you hours of labor and offer insight on your product performance.

Use Distributor Data to Estimate Unit Sales

While a vendor portal might be ideal when dealing with large accounts, they’re rarely available. In fact, 81 percent of companies say retailers don't share data with them freely. So when you can’t get sales data from the retailers themselves, it’s time to get creative.

When dealing with smaller shops, UNREAL Candy’s Regional Sales Manager Jeremy Leblanc suggests using data from your distributors to estimate your velocity off the shelf.

“Smaller mom and pop shops might not track your sales on a weekly basis, but your distributor knows exactly how many cases went into that store each week,” Leblanc explains. “If you know what’s on shelf, you can then find out exactly what has been sold.”

Use Your Field Team to Collect Data

If you’re unable to get data from your retail partners or distributors, you might be able to leverage your field team to collect information on sales velocity -- even if they’re not actively placing orders in the store.

For example, Altra Footwear sends its tech reps into sporting goods stores to educate the sales staff on their new products and make sure the displays are well organized. While they’re there, Altra’s reps look for and report out-of-stock instances.

Even though they use distributors to place new orders and fill those out-of-stocks, having OOS instances documented gives the brand a sense for how quickly its product are moving off the shelves, as well as which SKUs are selling fastest in which stores.

(Check out this free guide for more tips on collecting data out in the field.)

.png?width=480&height=252&name=PRESS%20RELEASE-2%20(4).png)