For CPG brands mastering the retail channel is a massive opportunity, but those who have played in the space before know it takes a committed investment to reap the benefits. To make the most of that investment, CPG sales and marketing teams are putting data at the forefront of their retail execution efforts, unlocking the insight they need to prioritize and maximize high-opportunity initiatives.

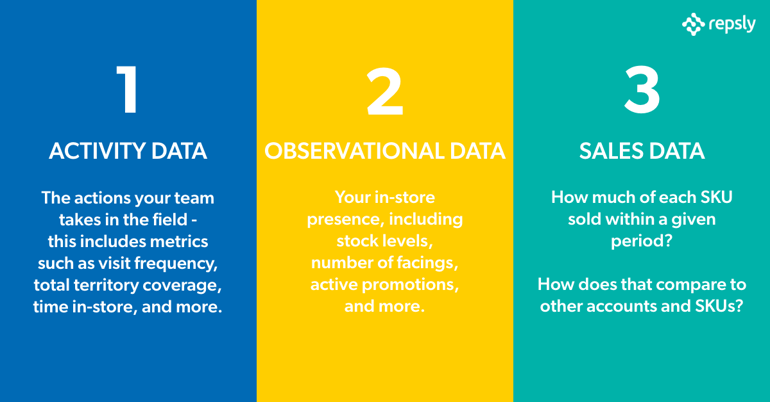

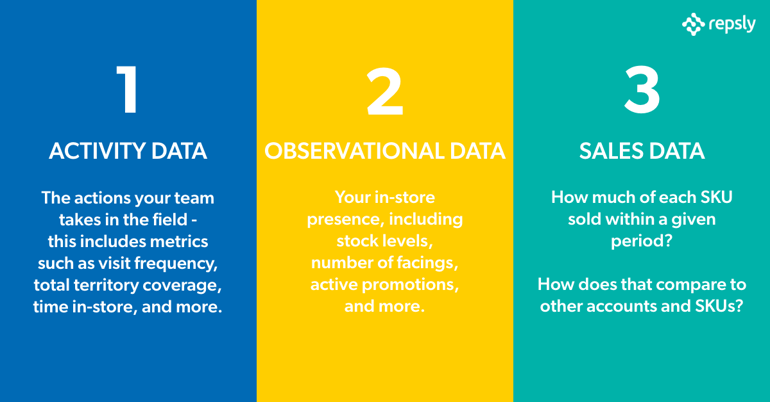

The most effective CPG field teams are building their retail execution strategies around three key types of data:

- Activity Data: The actions your team takes in the field - this includes metrics such as visit frequency, total territory coverage, time in-store, and more.

- Observational Data: Your in-store presence, including stock levels, number of facings, active promotions, and more.

- Sales Data: How much of each SKU sold within a given period? How does that compare to other accounts and SKUs?

Together, these three types of data give CPG sales and marketing organizations a complete picture of how their products are presented, sold, and supported in all of their accounts, shining a light on how and when brands can deploy their field teams to have the biggest impact in the store.

In this blog, we’ll outline how you can leverage observational, activity, and sales data to take a data-driven approach to:

- Expanding your in-store footprint

- Merchandising at the shelf

- Executing and maintaining brand promotions

- Running in-store sampling events

- Increasing chain penetration

Expanding Your In-Store Footprint

Activity Data:

Having a great product and strong initial sales are what get a product in-store, but consistent and reliable retail execution is how winning brands keep their product on the shelf and expand. Take a look at some of the ways brands are leveraging the data they collect on their team’s actions:

- Showing store managers that their reps are checking in regularly and maintaining displays helps to build confidence that future displays will be maintained just as well.

- Knowing when reps are next set to visit a retail location means brands can plan their pitches in advance, and know what other data they’ll have to support their arguments.

- When negotiations happen for multiple locations at once, brands use their activity data to show the completeness of their territory coverage - leaving retailers comfortable that those shelf locations will be properly set-up and maintained.

Observational Data:

Forward-thinking brands understand that to quickly improve sales within a chain or territory, they need a clear picture of what exactly their presence in each store is. Combining photos, structured data, and notes from their reps allows managers to paint a distinct picture of what’s happening in each store so that they can learn and improve each one. Here are a few ways the brands you love are leveraging this data:

- Reps should be having regular conversations with store-managers and trying to discover when the opportunity for additional placements may arise - when reps are consistently recording their interactions in-store, it becomes much easier to recognize and act on those opportunities.

- When sales are strong, reps look to see what kinds of shelf-placement or displays those sales occurred from - then present that data at a new store within the chain to justify those same placements.

- If sales have been lackluster, reps look to observational data to build a stronger case as to why their brand deserves more shelf space. In many cases, poor maintenance by the retailer or a recently-lost display are the cause of lost sales, and showing this to retailers can help you better maintain or re-secure those placements.

Sales Data:

Some of the fastest growing CPG brands worldwide are providing their reps in the field with POS data from the stores they sell into. By having this sales data in-hand, reps can build a narrative - backed by data - as to why their brand deserves that prime spot on the shelf. Here are just a few of the ways top teams are utilizing sales data to secure even higher sales at their top-priority chains.

- Giving teams access to POS data while on-the-go, so they can build their case for additional placements with store managers.

- Looking for out-of-stock indicators in sales data - if there is a pattern of steady sales followed by a steep drop-off, this is a good indication that you’ve lost a placement.

- Using strong initial sales from a new SKU to justify additional placement in-store.

- Using upward sales trends to prove demand for top products and make a case for secondary placements.

Merchandising at the Shelf

Activity Data:

By quickly iterating and better understanding what their reps are doing in the field, managers at top brands can help their teams become hyper-efficient. Here’s a few ways these brand keep their shelf-presence near-perfect every day:

- Tracking how long each rep spends in-store on a single visit and comparing that information to the quality of merchandising in the same stores is helping managers give their reps better feedback about where they need to spend more time.

- Keeping track of what route reps take between stores and optimizing that route over time to eliminate territory coverage problems and ensure that every store is properly merchandised.

- Knowing how consistently each rep on their team is collecting the right kinds of data (such as competitor data, shelf condition, etc.) from each account allows managers to address gaps in information and create high-priority stores where more info is needed.

Observational Data:

Contextual information can be the difference between properly evaluating your shelf-presence and scrapping a perfectly good setup. Data-driven brands understand this, and are taking these steps to ensure they see the full-picture:

- Having their team take photos of product on the shelf and on display every time they visit an account helps managers give feedback quickly and improve shelf presence.

- Instructing reps to collect information on where competitors are relative to their brand on the shelf. This can help educate where additional promotional materials should be run.

- Recording shelf position from store-to-store and comparing with sales data helps brands know where their product sells best, and what shelf space they need to fight for.

- Taking note of store condition - everything from the shelf their product sites on to the floor in front of the shelf - helps managers better understand which stores need extra care and which stores are in good shape.

Sales Data:

Proper category management and a good understanding of which SKU’s perform well together have helped many emerging brands catapult to success. Here’s a few things these brands are looking for in their sales data:

- Evaluating sales data for products where cross-merchandising is present is helping brands better choose where to sell complementary SKU’s.

- Understanding where they’ve cannibalized their own sales: if sales drop for an existing SKU after introducing a new product nearby, reps should know and managers should be ready to take action.

- Complying to end-of-life guidelines: if sales of a SKU continue after that product should be retired from the shelf, reps can quickly identify and address this while visiting their account, removing that product from the shelf and replacing it with whatever new SKU the brand now intends to sell.

Executing and Maintaining Brand Promotions

Activity Data:

Regardless of the size of a brand, it’s up to reps in the field to properly setup and maintain those promotions. That means being timely, on-brand, and consistent. Check out how the most reliable brands do just that:

- Ensuring a coordinated promotional rollout by scheduling each of their reps account visits, setting specific tasks for them to execute upon arrival, and then reporting on that data to identify any gaps.

- Comparing rep time in-store to the expected time it takes to appropriately set up a display to highlight potential problem areas - or identify super-efficient reps.

- Maintaining the boost in sales from additional displays by keeping track of when each rep last serviced each of their accounts.

Observational Data:

Broken shelf-talkers, beaten-up displays, and bent price tags are the bane of branding experts at big consumer brands. If promotions aren’t properly run and maintained, their full potential can’t be realized and the sales impact from them cannot be properly measured. Here’s how top brands make sure their promotions are given a fair shake:

- Making sure that displays stay in top condition and adhere to brand guidelines by having reps collect photos and fill out quick surveys on various aspects of a promotion.

- Improving current and future promotions by recording information like shopper reception, foot-traffic.

- In those cases where it’s the job of the retailer to maintain a promotion or display, regularly checking in and confirming that everything is in order ensures that both parties are holding up their end of the bargain.

Sales Data:

Brands run promotions for a number of reasons, but by far the most common objective is increased sales. Understanding the impact a specific promotion has on sales is how large brands consistently run “winning” promotions through wildly different retailers.

- Looking at sales lift from previous promotions to determine which promotions to run at specific retailers. Combing sales data with observational data has made it easy for brands to be prescriptive in their promotional strategy.

- Looking for immediate change in sales after a promotion is set to begin - if there’s no apparent change in sales trends, it may mean that the promotion has not been properly set up.

- Using sales data from previous promotions to justify running those promotions in other retail locations within the same chain.

Running In-Store Sampling Events

Activity Data:

The most important step towards successful in-store events is ensuring they happen to begin with. Whether they use an in-house team or outsource their event execution, top brands ensure compliance from their team in the following ways:

- Requiring check-in and store manager sign-off for sampling events to ensure that events are happening when they’re supposed to and where they’re supposed to.

- Measuring time in-store during sampling events to ensure that events run for the full duration and proper data can be collected.

Observational Data:

Sampling events are a rare instance where reps interact with both direct customers and the retailer - there’s little room for error when the reputation of the brand is on the line. These are a few of the ways modern brands are monitoring and optimizing their event execution:

- Collecting information on how many samples were given out to see if this has an impact on immediate and future sales.

- Recording perceived foot-traffic in the store during the product sampling event so that the event itself can be properly evaluated.

- Collecting customer responses to your sample that you can bring back to your product and marketing teams.

- Taking social-media worthy photos that can be used to build buzz for the product within a specific location.

Sales Data:

Running in-store events is a serious investment of employee time and money, so justifying the cost of such events is of the utmost importance to rising brands. Here are a few ways brands are using sales data to validate past events and justify future ones:

- Determining the sales lift (if any) that sampling events have on immediate and future sales.

- Looking for disparity in sales-lift between stores that are running the same sampling events - this may indicate issues with the execution of the sampling event itself.

- Utilizing sales data from previous sampling events to justify new placements or to secure a future sampling event with the same retailer.

Increasing Chain Penetration

Activity Data:

While managers often have a good idea about what stores their reps should be targeting to sell into, it’s ultimately up to those reps in the field to execute. Managers aware of how much additional territory coverage a rep can provide are better equipped to go after new accounts with the confidence that they’ll be properly secured and maintained - here’s a few of the ways managers are gaining that awareness.

- Optimizing visit frequency and routes of their teams to ensure that territories are being completely covered.

- Seeing which members of their team have the most downtime between visits so that they can take on additional stores in their territory.

- Having reps check-in at prospective locations to collect store information - this allows their managers to develop a strategy for getting into that account.

Observational Data:

Data-forward brands are almost never afraid to show potential retailers their history at other accounts. A well-run brand has plenty of photos and records of their work at other locations. Collecting the information below helps set the tone of the retailer-brand relationship going forward and lets retailers know they have a partner - and not just a customer - in the brand they’ll be working with.

- Showcasing a history of consistent merchandising excellence at similar retail locations using photos and notes to build confidence in store managers at prospective accounts.

- When the opportunity presents itself, using differences between retail locations to show opportunity to the store manager - if sales were great in a store with low foot-traffic and poor condition, imagine what they could be in your store!

Sales Data:

Good sales will make any pitch go much smoother. While it’s not necessarily a good idea to share sales data between chains, sharing data within a chain is usually OK. Instilling confidence in store managers with the data below is often the quickest way for brands to get their product in new stores.

- Leveraging their portfolio of great sales data from different stores within a chain to make a strong case for moving into a new location. Managers are looking to nearby stores with similar demographics, size, etc, and compiling recent sales data to convince the buyer that they’ll be a great addition to the shelf.

- Showing the lift in sales created by promotions and sampling events at other accounts in order to secure those opportunities early-on at a new retailer.

- Presenting sales of only their best-selling SKU in order to get a foot in the door - then moving forward with their full product line once they’ve built a more concrete relationship with the retailer.

Achieving Data-Driven Retail Execution at Scale

Many of the fastest-growing consumer brands in the world are using these three data-types to gain huge competitive advantages over other brands in their space. While all of these tactics may appear simple on paper - the ability to scale up each of them up is what separates the truly successful brands from the average.

One integral piece of every data-forward brand strategy is having structured and reliable data. Collecting data at scale, aggregating it easily, reporting on it, and drawing insights from that data is how top brands quickly and consistently iterate across large territories

There are plenty of ways for teams to collect data while in the field. For small teams of only 2 or 3 people, sending texts or emails and keeping data in an Excel or Google Sheet file may work just fine. Larger brands however, will almost always use a platform built specifically for collecting this data. In the long run this saves them time on data collection, organization, and on reporting.

Keeping data organized is an extremely undervalued part of most companies scaling efforts. Without an easy way to aggregate and reference large amounts of data, managers and their teams quickly lose focus of what’s working and what’s not. A system that can filter and tag reps, accounts, and products helps large brands keep organized at scale.

.png?width=480&height=252&name=PRESS%20RELEASE-2%20(4).png)