Mastering the retail channel is a massive opportunity for CPG brands, but those who have played in the space before know it takes a committed investment to reap the benefits. To make the most of that investment, CPG sales and marketing teams are putting data at the forefront of their retail execution efforts, unlocking the insight they need by prioritizing and maximizing high-opportunity initiatives.

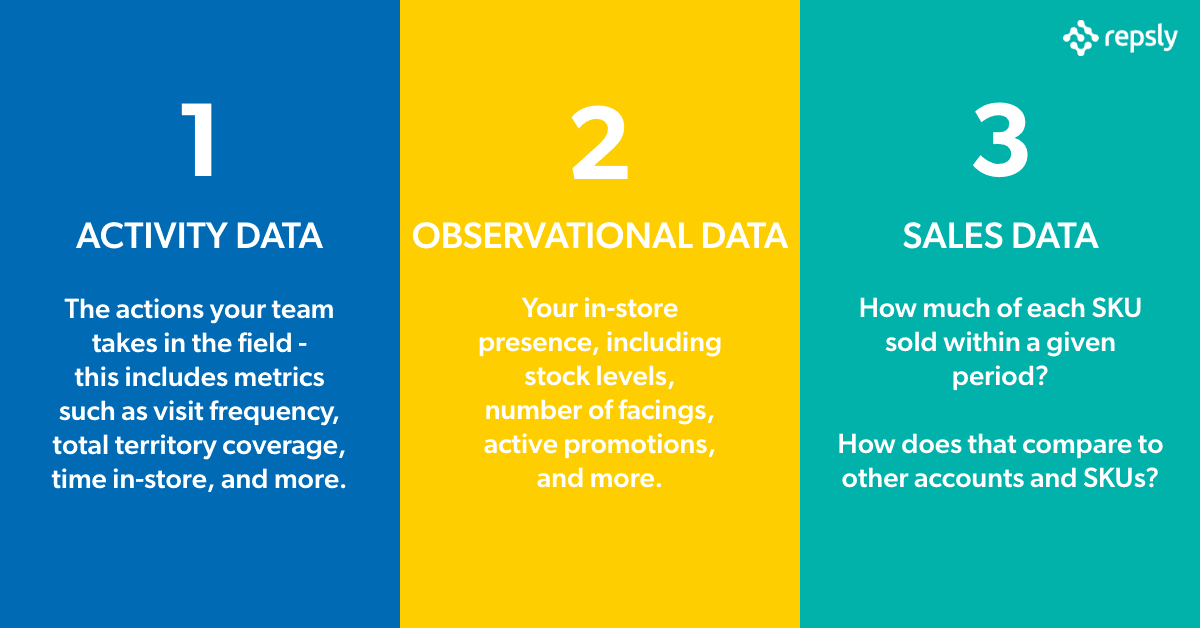

In this blog, we’ll outline how you can take a data-driven approach to increase chain penetration by leveraging activity, observational, and sales data.

Activity Data:

While managers often have a good idea about what stores their reps should be targeting to sell into, it’s ultimately up to those reps in the field to execute. Managers aware of how much additional territory coverage a rep can provide are better equipped to go after new accounts with the confidence that they’ll be properly secured and maintained.

Brands should be regularly tracking the actions the team takes in the field, including metrics such as visit frequency, total territory coverage, time in-store, and more. This type of data is referred to as activity data. Here are a few of the ways managers are gaining that awareness:

- Optimizing visit frequency and routes of their teams to ensure that territories are being completely covered.

- Seeing which members of their team have the most downtime between visits so that they can take on additional stores in their territory.

- Having reps check-in at prospective locations to collect store information - this allows their managers to develop a strategy for getting into that account.

Observational Data:

Data-forward brands are almost never afraid to show potential retailers their history at other accounts. We can show potential retailers the brand’s in-store presence, including stock levels, the number of facings, active promotions, and more through observational data. A well-run brand has plenty of photos and records of their work at other locations.

Collecting the information below helps set the tone of the retailer-brand relationship going forward and lets retailers know they have a partner - and not just a customer - in the brand they’ll be working with.

- Showcasing a history of consistent merchandising excellence at similar retail locations using photos and notes to build confidence in store managers at prospective accounts.

- When the opportunity presents itself, using differences between retail locations to show an opportunity to the store manager - if sales were great in a store with low foot-traffic and poor condition, imagine what they could be in your store!

Sales Data:

Good sales will make any pitch go much smoother. While it’s not necessarily a good idea to share sales data between chains, sharing data within a chain is usually OK. By measuring sales data, brands have the ability to track key metrics including how much of each SKU sold within a given period, how their product compares to other accounts and SKUs, and if a sampling event makes sense in a given location.

Instilling confidence in your store managers with the data below is often the quickest way for brands to get their products in new stores:

- Leveraging their portfolio of great sales data from different stores within a chain to make a strong case for moving into a new location. Managers are looking to nearby stores with similar demographics, size, etc, and compiling recent sales data to convince the buyer that they’ll be a great addition to the shelf.

- Showing the lift in sales created by promotions and sampling events at other accounts in order to secure those opportunities early-on at a new retailer.

- Presenting sales of only their best-selling SKU in order to get a foot in the door - then moving forward with their full product line once they’ve built a more concrete relationship with the retailer.

Together, these three types of data give CPG sales and marketing organizations a complete picture of how their products are presented, sold, and supported in all of their accounts, shining a light on how and when brands can deploy their field teams to have the biggest impact in the store.

Many of the fastest-growing consumer brands in the world are leveraging the insights they gain from activity, observational, and sale data to gain huge competitive advantages over other brands in their space.

Explore the 3 Types of Data to Explode Sales to learn four more ways high-performing retail brands are leveraging structured and reliable data to have the biggest impact in the store.